Our features

Built for energy markets. Backed by real-world modelling.

Load Forecasting

Predict energy demand patterns and plan supply with confidence.

Automated reports

Generate powerful insights from real-time and historical market data.

Scenario Modelling

Test energy contracts and simulate risk with lightning-fast what-if analysis.

Price Forecasting

Project market prices with accuracy to stay ahead of volatility.

Weather Integration

Model renewable output based on forecast weather and climate data.

Visual Dashboards

Explore simulation results and market trends in a clean, interactive UI.

Why TechCode

What makes us stand from the rest

Lorem ipsum dolor sit amet consectetur eros sodales est mi lectus habitant auctor pharetra hendrerit elementum.

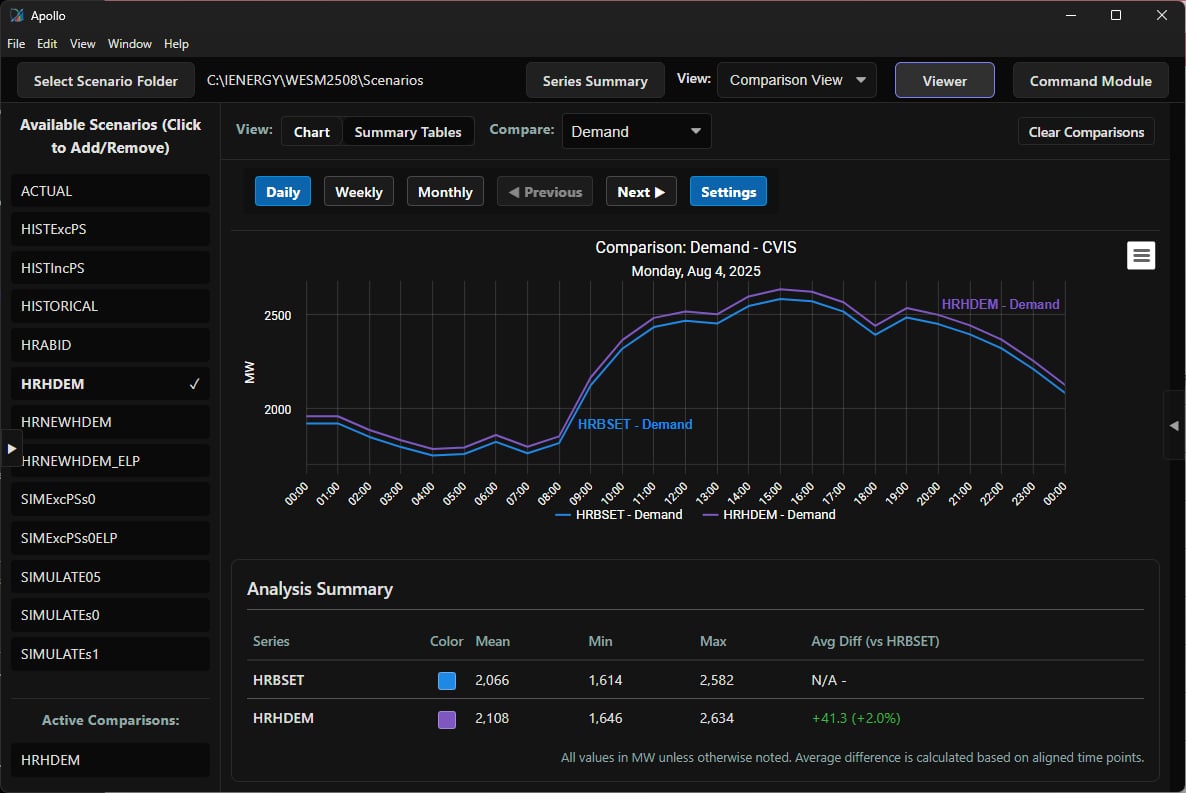

Scenario Modelling / What‑If Simulations

Stress-Test Contracts

Simulate how price spikes, outages, or new conditions impact your portfolio.

Predict Market Reactions

Model different outcomes over days, months or even years into the future.

Historical Data Aggregation & Automated Analysis

Smart Error Detection

Instantly flag inconsistencies across datasets and keep simulations market-aligned.

One-Click Reports

Aggregate and analyse years of energy data with automated reporting tools.

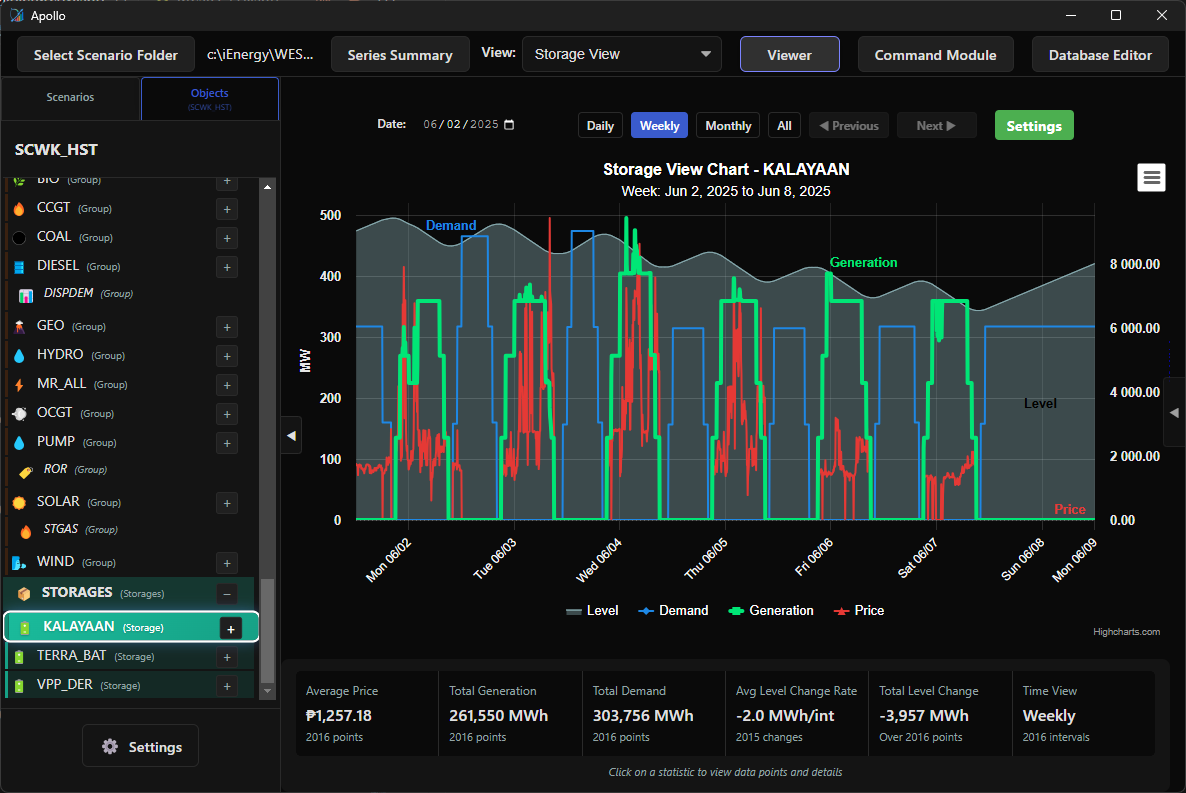

Load Profiling & Load Forecasting

Forecast Energy Demand

Build load profiles to understand customer usage patterns with precision.

Plan for Supply & Demand

Model peak periods and low loads to better manage generation and buying.

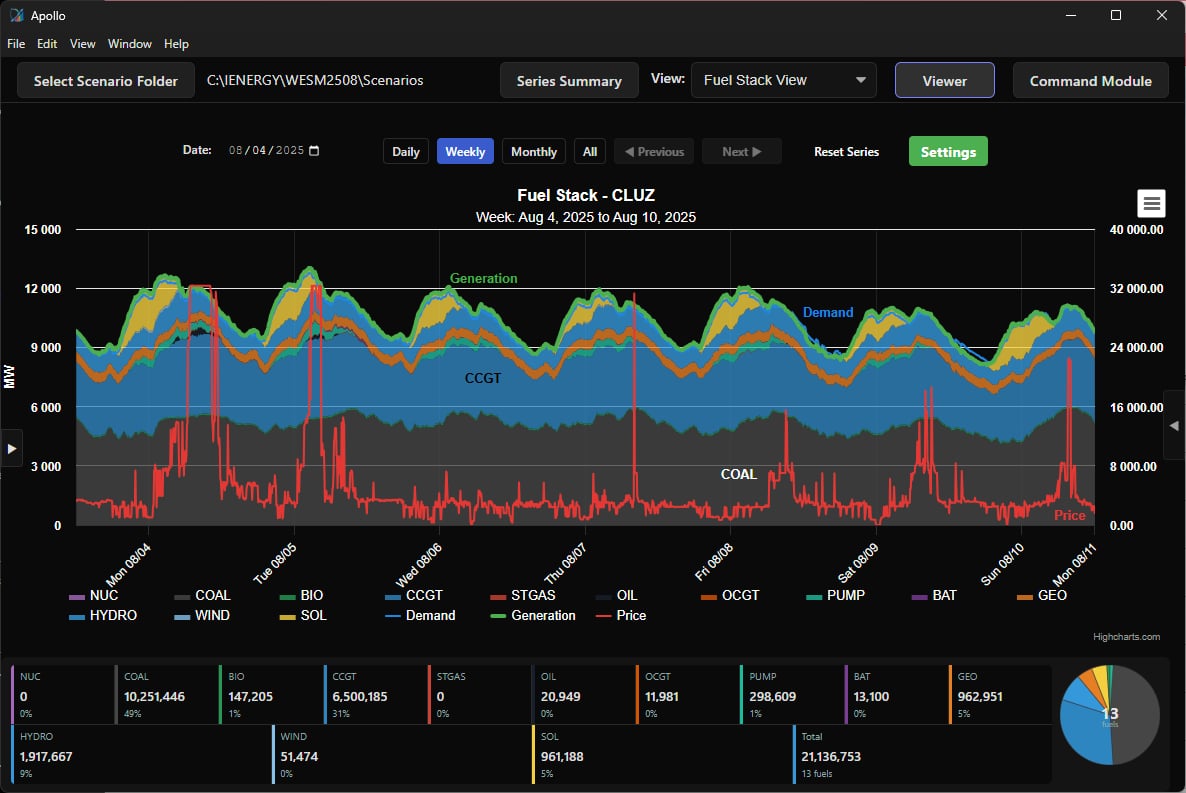

Accurate Price Forecasting

Project Price Trends

Use historical and real-time data to forecast short and long-term pricing.

Reduce Financial Risk

Support trading and contract strategies with price prediction insights.

Weather Data Integration for Renewables

Simulate Renewables Output

Integrate forecast data for solar and wind to predict generation shifts.

Adapt to Climate Events

See how weather impacts your capacity to meet energy commitments.

.png)